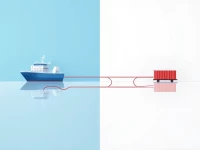

Key Differences Between Master and House Bills of Lading Explained

This article provides an in-depth analysis of the differences between Master Bill of Lading (MBL) and House Bill of Lading (HBL), comparing them across various aspects such as issuer, document of title, exchange procedures, and applicable subjects. It offers practical advice and risk avoidance guidelines for selecting the most suitable bill of lading solution in different business scenarios. The aim is to assist foreign trade enterprises in choosing the optimal bill of lading option to reduce costs and mitigate risks associated with international trade and customs clearance.